Bitcoin at a Crossroads: 3 Critical Events Shaping Its Next Move

Bitcoin at a Crossroads: 3 Critical Events Shaping Its Next Move

The Bitcoin Core Relay Policy Debate That’s Dividing Miners

The Bitcoin Core team’s new relay policy - limiting non-standard transactions including Ordinals and Lightning Network hacks - has sparked what I call “The Great Validator Schism of 2024.” Watching developers argue about transaction filtering feels like witnessing blockchain’s version of constitutional originalism vs. living document theory.

Why this matters:

- Potential impact on L2 protocols (Runes down 18% since announcement)

- Historical precedent: Similar debates preceded both BCH fork and Taproot activation

- Governance question: Can decentralized systems avoid centralized decision-making bottlenecks?

My take? This won’t trigger another hard fork (yet), but it exposes Bitcoin’s growing pains as it evolves beyond Satoshi’s original vision.

Treasury Yields Playing Chicken With Crypto

With 10-year yields at 4.51% (26bps above long-term average), traditional finance is offering serious competition for investor dollars. The math is simple:

Risk-free return ↑ = Risk asset appeal ↓

Yet paradoxically, our latest institutional flow data shows:

- $2.1B moved into crypto ETPs last quarter

- Grayscale’s GBTC saw first inflows since January

This suggests some investors view crypto as an “inflation hedge hedge” - insurance against the dollar weakening faster than rates rise.

ETF Flows: The Market’s Mood Ring

Bitcoin ETF approval was supposed to be the finish line. Turns out it was just the starting blocks. Current observations:

- Net outflows during price drops suggest weak-handed investors still dominate

- But options market shows growing institutional interest in long-dated calls

- SEC’s stance on ETH ETFs remains the next regulatory domino

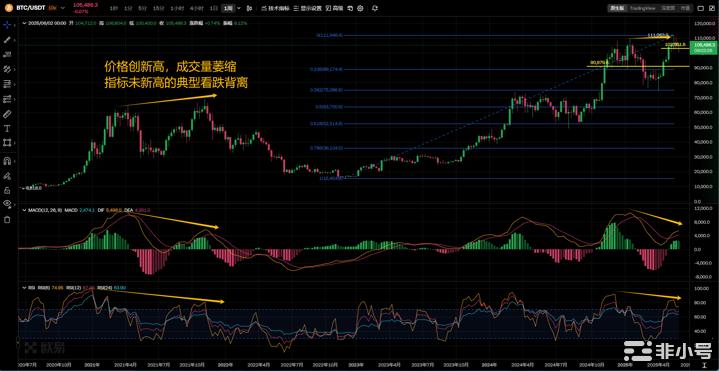

Technical Checkup (because charts don’t lie… usually)

Concerning signals:

- Bearish RSI/MACD divergence resembling 2021 top

- Volume declining on rallies since March

Key levels to watch:

| Support Zone | Significance |

|---|---|

| $103k | Short-term trader defense line |

| $91k | Institutional accumulation zone |

| \(63-\)65k | Bull market make-or-break area |

The bottom line? We’re in a high-stakes game where protocol politics meets macroeconomics meets meme-fueled speculation. As always in crypto, expect volatility - but now with better liquidity.

ZenChainX

Hot comment (15)

Bitcoin precisa de terapia de casal

Essa briga entre miners e core developers parece aquela discussão de quem esqueceu o leite no mercado - todo mundo errou, mas ninguém assume!

Yields vs Crypto: O novo BBB

Quando os juros sobem, a galera fica dividida: vai pro Tesouro ou HODL? Parece minha tia escolhendo entre novela e futebol!

ETFs: A montanha-russa emocional

Aprovados mas ainda chorando… esses ETFs estão mais indecisos que eu no rodízio de sushi!

E aí, time HODL ou time ‘vou esperar cair mais’? 😂

Bitcoin en la encrucijada más dramática desde telenovela venezolana

Entre el debate de los mineros (que parece pelea familiar por la herencia), los rendimientos del Tesoro jugando al gallito con las criptos y los ETFs más volátiles que mi suegra… esto es mejor que Wall Street.

¿Quién dijo que las finanzas eran aburridas? Ahora hasta los gráficos tienen más drama que mi ex.

¡Comenten! ¿Creen que Bitcoin sobrevivirá a este reality show financiero?

Bitcoin’s getting spicy again!

First, we’ve got miners fighting over transaction policies like it’s blockchain constitutional law - who knew validators could be this dramatic?

Then traditional finance tries to steal the show with those juicy yields, but crypto says ‘hold my beer’ as institutions still pile in.

And ETF flows? More unpredictable than my ex’s mood swings.

Place your bets folks - will Bitcoin moon or faceplant? The comment section is now open for wild predictions! 🍿

Bitcoin en la encrucijada más épica desde “El Padrino”

¡El debate del Core Relay nos da todo: drama político blockchain, mineros peleando como en el Congreso, y memes de Runes cayendo más rápido que mi abuela bajando las escaleras! 😂

Y luego está el Tío Sam jugando al pilla-pilla con los rendimientos… ¿4.51%? ¡Vaya chiste! Pero oh sorpresa, mientras todos miran allí, los tiburones institucionales están comprando como si no hubiera mañana.

Y para rematar: los ETFs que prometían ser el final resultaron ser sólo el aperitivo. ¿Próximo capítulo? El SEC decidiendo si ETH merece su propio drama televisivo.

¿Estamos ante una tragedia griega o la mejor oportunidad de compra del año? ¡Ustedes qué opinan, cracks! 🔥

Bitcoin em terapia financeira

O Bitcoin está tendo sua própria crise dos 30 anos! Primeiro, os desenvolvedores do Core discutindo políticas de relay como se fosse um reality show de blockchain. Depois, os rendimentos do Tesouro americano tentando roubar nossa atenção (e nosso dinheiro). E por último, os ETFs que prometiam ser o final feliz e viraram só o primeiro capítulo.

Minha opinião? Isso tá mais dramático que novela das nove! Mas sério, se você gosta de emoção forte, o Bitcoin continua sendo o melhor roteiro. O que acham? Vai dar fork ou vai dar certo?

Bitcoin’s Identity Crisis Watching Bitcoin Core debate transaction filtering is like seeing your grandparents argue about TikTok - painful but oddly fascinating.

The Yield Tug-of-War 4.51% Treasury yields? That’s crypto’s new frenemy. Investors treating Bitcoin like an ‘inflation hedge hedge’ - because why choose one hedge when you can hedge your hedge?

ETF Mood Swings Turns out ETF approval was just the first lap in this marathon. Current price action suggests we’ve got more emotional traders than a middle school dance.

Key question: Will Bitcoin grow up or keep acting like a rebellious teenager? Place your bets!

¡Bitcoin está más dramático que telenovela venezolana!

Entre las peleas de los mineros por las políticas del Core y los rendimientos del Tesoro jugando al gallina, esto parece más un culebrón que un mercado financiero.

Lo mejor: ¡Los ETF son como el termómetro del ánimo del mercado! Un día suben, otro bajan… ¿Alguien tiene un Xanax para los inversores?

Y tú, ¿en qué equipo estás: Team HODL o Team “Vendo en pánico”? 😂

Bitcoin’s Having an Existential Crisis

Watching Bitcoin’s Core team debate transaction policies is like seeing your grandparents argue about TikTok etiquette - painfully outdated yet weirdly fascinating.

Yield Wars: The Ultimate Flex

When 4.51% Treasury yields start flexing on crypto, you know we’re in for a wild ride. But hey, at least our volatility comes with memes!

ETF Mood Swings

Turns out ETF approval was just the first lap in this marathon. Now we get to watch institutional money panic-sell at the first dip - classic weak hands.

Drop your hot takes below - will Bitcoin fork, flop, or moon?

When Bitcoin Hits Puberty

Watching Bitcoin navigate these three events is like witnessing a teenager’s identity crisis - will it rebel against Core developers? Flirt with traditional finance? Or just moodily stare at ETF charts?

The miner debate proves blockchain governance is messier than a group project. Meanwhile, Treasury yields playing hard-to-get might actually make crypto more attractive - nothing sparks desire like scarcity!

Pro tip: That RSI divergence isn’t just technical analysis… it’s Bitcoin’s existential dread showing. Place your bets - will this midlife crisis end with a Lambo or a yoga retreat?

Drop your predictions below - therapy bills not included!

Bitcoin: el culebrón que nunca termina

Entre el debate de los mineros (más divididos que una blockchain hard-forked), los rendimientos del Tesoro jugando al ‘quítame tú estos dólares’ y los ETFs más volátiles que mi suegra… ¡vaya telenovela!

Lo mejor: Cuando los inversores usan crypto como ‘seguro contra el seguro’ de inflación. ¿Esto es finanzas o un juego de tronos?

Y tú, ¿en qué bando estás? ¿Team ‘HODL’ o Team ‘Corre que te alcanzo’? 😂

Bitcoin se ha vuelto más dramático que una telenovela

Entre políticas de relay que dividen mineros, rendimientos del Tesoro jugando al gallina y ETFs más volátiles que mi ex… ¿en qué quedamos?

Lo único seguro es que si Satoshi viera esto, pediría un reinicio de la blockchain.

¿Tú en cuál de estos tres frentes apuestas? 🍿

Bitcoin baila el tango de la volatilidad

¡Qué lío más divertido! Bitcoin está más indeciso que yo eligiendo zapatos para milonga. Por un lado, los mineros discuten como abuelos sobre política (¿otro cisma en la familia? 😅).

El dato picante: Los ETF fluyen más que mis lágrimas cuando el BTC cae. Pero ojo - ¡hasta Grayscale volvió a la fiesta después de meses!

¿Mi predicción? Esto va a estar más movido que una noche de tango en San Telmo. #HODLearComoArgentino

¿Vos qué pensás? ¿Compramos dips o esperamos el próximo drama?

The Great Bitcoin Civil War

Watching Bitcoin Core and miners fight over transaction policies is like seeing your divorced parents argue at Thanksgiving - except here, the turkey is our portfolio.

Treasury Yields: The Silent Killer 4.51% risk-free returns? That’s crypto’s version of that ex who texts you ‘U up?’ during a bull market.

ETF Mood Swings BTC ETFs proving institutional investors have diamond hands… until the first 10% dip hits.

Place your bets folks - are we heading to \(103k or revisiting \)65k trauma? The charts know (maybe).

Bitcoin no fim da linha?

Parece que o BTC está num dilema de novela mexicana: mineração vs. protocolo, juros vs. especulação… e ninguém sabe quem vai ganhar o Oscar do mercado.

O debate da nova política de relay é tipo o jogo do Corinthians contra o Flamengo… só que com código-fonte e sem goleiro.

E os juros do Tesouro subindo? Ah, meu amigo, agora até o Bitcoin tá pensando em fazer um CDB.

ETFs movendo $2,1B? É como se o Brasil tivesse comprado todo o petróleo do mundo… mas com cara de quem não entendeu nada.

Vamos ver se $63k sobrevive ao próximo meme ou se vai ser só mais uma “crise” para vender NFTs de pão sírio.

Você tá com qual lado? Comenta ai e vamos ver quem sai vivo dessa corrida!

#Bitcoin #DeFi #CriptoPT

O Bitcoin tá no crossroads… e o pessoal ainda insiste em usar o Lightning como samba! Miners trocando transações como se fosse um desfile de carnaval — só que com wallets em vez de fantasias. O ETF chegou? Claro! Mas será que o mercado vai suportar isso ou vai virar um ‘hedge’ com moqueira? Ei, gente… se o dólar está fraco, então o BTC tá mais forte que um churrasco na praia. E você? Já comprou seu bit ou tá só olhando?

- Opulous (OPUL) Price Volatility: A 1-Hour Snapshot Analysis for Crypto TradersAs a seasoned crypto analyst, I dissect Opulous' (OPUL) erratic 1-hour price movements—from a 4.01% surge to sudden dips—with trading volume and turnover rate insights. Whether you're scalping or hodling, this micro-trend breakdown reveals hidden patterns in the chaos. Spoiler: The charts have more mood swings than my ex during a Bitcoin crash.

- Crypto 101: How to Navigate OTC and Spot Trading Like a ProEver wondered how to swap your fiat for crypto without losing sleep over volatility? As a seasoned crypto analyst, I'll break down OTC trading (the 'eBay of crypto') and spot trading in under 5 minutes. Learn why USDT is your safest onboarding ramp, how to dodge rookie mistakes, and why that 'Buy BTC' button isn't what it seems. Spoiler: It involves less wizardry than you'd think.